Clea Bourne, Paul Gilbert, Max Haiven and Johnna Montgomerie

This special section of Discover Society emerges from a two-day gathering of scholars, activists and artists dedicated to the theme at Goldsmiths, University of London, in September of 2017. Its inspiration comes from a certain frustration with the emergent interdisciplinary field of critical finance studies, which, regrettably (and with some noble exceptions), has not yet elected to enter into a vibrant dialogue with fields such as post-colonial criticism, critical race studies and settler-colonial studies. We believe such an avoidance is tragic, given not only the vibrancy of all of these fields but also the reality that many of the phenomena associated with finance, finance capital and financialization cannot be fully understood without reference to imperial, colonial and racialized realities, past and present.

That gathering, and this edition, was also deeply inspired by the momentous political, economic and cultural shifts revealed by the 2016 Brexit vote and the election of Donald Trump, as part of a massive global reactionary wave in the decade following the 2008 financial crisis and the death (or perhaps the gory afterlife) of the Washington Consensus. Here, in response to political-economic realities, we have witnessed the cultural and political weaponization of racialized nostalgia with tremendous political-economic motivations and ramifications. Nostalgia for imagined times of imperial pride, of racial purity, of class harmony has a deep hold on the imagination of the public and of policy-makers, but it also haunts the imagination of many scholars in the absence of a sustained attention to the entanglements, histories and legacies of colonialism, empire, race and racialization, and racial capitalism.

With these urgent matters in mind, we invited an interdisciplinary array of scholars and other writers to respond to our call to reimagine financialization in the following terms.

Colonial Debts

Contemporary discussions of debt, financialization and neoliberal capitalism have often elided the ideological, technical, political and cultural roots of these phenomena in the colonial world order. It has also generally side-lined the importance of debt and finance in structuring the post-colonial world order. How can we better understand present-day wealth, power and technology by tracing the entanglements of high finance, the insurance industry and real-estate speculation in the violent flows of empire? How does a robust theorization of race and racism enhance our understanding of financialization, debt and punitive economic power; and, vice-versa: in what ways is the landscape of race and racism changing amidst the set of trends known as financialization?

Extractive Nostalgias

While certain aspects of financialization and ballooning personal and government indebtedness must be acknowledged as emergent phenomena, how and when is the assumption of their “nowness” dependent on the production of a fictitious “before”? By “extractive nostalgia” we aim to name the political and economic mobilization of problematic anachronisms when it comes to narrating the neoliberal present, and, therefore, to imagine better potential futures. How is this nostalgia for a time “before” debt and austerity haunted by the spectres of slavery, colonialism, empire and organized and systemic racism? From whence, or from whom, did “our” now-vanished wealth spring? What kind of extractive relations – past, present and future – are obscured by attempts to rescue the “real” economy from the vagaries of financialization and speculation? By mobilizing this term, we want to call attention to the questions of who extracts value from nostalgia, whose labours are exploited, and what toxic residues and forced displacements might be the result.

Imperial Insolvencies

Today, we are told that the political spectrum is monopolized by the struggle between neoliberal globalists and neo-nationalist populism. But what does this false or at least overly simplistic binary hide about the roots of today’s crisis in the histories and legacies of empire? What can we learn from debates about past and present struggles for reparations, for the repatriation of stolen lands, or for the return of looted cultural treasures? How can an effort to measure the odious or exploitative debts that burden the oppressed with the moral or historical debts owed by the oppressors open new horizons for thinking beyond “the crisis”?

What is at stake in asking such questions today? No one can doubt that we are somewhere in the vicinity of a great pivot point in world history, if only because of the monumental challenges that now face humanity thanks to the unleashing of climate change, the authoritarian turn, or the great migrations underway.

Britain’s haunted investments

The burgeoning fields of critical finance studies and the sociology of finance have begun to tease out the technical expertise and social networks through which the opaque worlds of finance operate. This has created important opportunities for deeper scholarly and broader public understandings of a domain that shapes and conditions so many of our daily experiences – from reliance on privately-funded ‘public’ infrastructure, to student indebtedness and the search for a viable retirement income. But in order to tell a more complicated, robust and potentially transformative story we must attend to the colonial, imperial and racial dimensions.

Some examples from financialization in the UK are illustrative of the potential for this frame of analysis.

Writing in Discover Society in 2014, Sarah Hall detailed how financial elites – the ‘working rich’ – in the City of London reinvented themselves after the recent financial crisis as intermediaries providing wealth management services and “choreographing” international financial networks. The City has certainly changed since the pre-Big Bang era in which financial power was vested less in coordinated networks of accountancy firms, law firms and fund managers, and more in a tightly-networked set of families connected by marriage and shared schooling.

And yet, the post-2008 reinvention of London’s ‘working rich’ as a financial services elite, rather than an old-boys network of private bankers, is not without colonial precedent. Indeed, the City of London owes its status as a global financial centre in no small part to the role that it adopted as ‘the world’s great middleman’, facilitating Imperial expansion by the European powers since the 18th century [1].

Further, by sending savings from an emerging “service elite” in the South of England abroad to the colonies, the City also contributed to a rift between the financing of provincial industry and the burgeoning financial sector, whose persistence has been charged with shaping the geography of the Brexit vote. Nostalgic yearnings for the reversal of Britain’s industrial decline, a taming of finance, and the recovery of a ‘productive’ economy – by no means a recent development in British political discourse – write over a history of British regions and the ascendancy of the City of London, which cannot be disentangled from the history of colonial expansion.

Recently, economic geographers [2] and campaigners for tax justice have mapped ‘Britain’s Second Empire’; the network of former possessions and overseas territories that lies at the heart of a global network of offshore finance, tax evasion and tax avoidance. Not only does the geography of empire linger in the organization of offshore finance (in which the City of London is a vital node), but the use of offshore jurisdictions to facilitate capital flight from countries in the Global South continues to decisively undermine the ability of ostensibly post-colonial nations to control their own national development agendas. The persistence of these imperial geographies of finance gives the lie to claims made by pro-Empire historians that the ‘gift’ of Imperial legal systems has been vital for allowing development, facilitated by “productive capital flows from rich to poor countries” [3].

From financial empires to financialized colonialities: logics and imaginaries

But there is more to the relationship between empire and finance than a simple recognition that the forces which shaped colonial expansion have left their mark on the contemporary world; Indeed, the notion that formal decolonization entailed an end to colonialism has been heavily critiqued by scholars of the ‘Decoloniality’ school. The persistence of relations which shaped colonial rule, provided its violent and extractive character, and rested upon the hierarchical classification of governed populations along racialized lines. This constitutes the persistence of coloniality, if not colonialism, as Vincent Guermond and Ndongo Sylla demonstrate in their contribution to this issue. Guermond and Sylla demonstrate that in former French African colonies, the maintenance of a currency pegged to the Euro and underwritten by the French Treasury has undermined independence, frustrated development, and shaped an economy in which migrants to France are subjected to hostile treatment and economic exploitation. Migrant remittances, meanwhile, provide the collateral for ‘nano-loans’ taken out by family members cut off from conventional banking and broader investment in regional development.

In addition, the logics underpinning financial innovation and calculation, and the imaginaries underpinning the speculative endeavours that emanate from the City of London and other global financial centres bear traces of their colonial predecessors. As Lisa Tilley shows in her contribution to this special issue, the innovations in terminology and the production of new indexes which allowed countries of the Global South to be viewed as “emerging markets” akin to markets in the USA may well be a very recent product of the search for new opportunities among portfolio investors in North America’s ‘shareholder democracy’. Indeed, the speculative allocation of capital through which financiers seek to pre-empt, provoke and profit from uncertain futures is frequently animated by racialized images of unruly “Others”, or nostalgia for the financial “stability” offered by Imperial rule.

The conceptual alloys of racism and accumulation forged in the crucible of colonialism and empire endure to the present, when, for instance, they inform the allegedly value-neutral calculative processes of financial risk-management. For instance, Thomas Koelble and Edward LiPuma [4] have described the “self-fulfilling prophecy” that arose when currency traders devalued the South African rand “based on the market’s assessment of risk (the risks caused by failure to privatize, the counter-party risk posed by a Black African government on a continent where government failure is endemic, the risk that the HIV/AIDS epidemic would drain government funds”: this speculative currency devaluation triggered by anxieties about a post-Apartheid government was precisely the catalyst that caused the economy to stumble.

(E)raced debts

As critical finance studies and the sociology of finance have grown, the absence of a concern with race and coloniality has become more marked. Almost a decade ago Maureen Sioh remarked on the absence of studies dealing with race or gender in the sociology or geography of finance [5]. Important work addressing these issues has emerged in the wake of the financial crisis. But with a few notable exceptions there has been little dialogue between postcolonial studies and cultural studies scholars concerned with colonialism and finance, and sociologists of financial practice and technique. The sociology of finance has perhaps suffered from what Michael Rodriguez-Muniz terms “ontological myopias” that exclude considerations of colonialism and coloniality: the “taken-for-granted assumptions about the nature and workings of the social world” [6] adopted by many sociologists of finance deliberately exclude ‘macro-sociological’ and historical forces from acting as explanations, and accept that a blunting of oppositional passion may be necessary for carrying out work in the sociology of finance [7]. The fetishization of calculative technique, financial innovation and technical arrangements in the sociology of finance has involved a reliance on the work of Bruno Latour, whose desire to craft a sociology that overcomes what he dismisses as the “tedious resentments of anti-imperialism” has perhaps contributed to the perpetuation of a post(?)-imperial amnesia.

Sioh’s own work is an exemplar of how the political economy of finance can be integrated with postcolonial theory. In the wake of formal independence, Malayan elites decided to remain in the British sterling area – despite the far greater economic gains they stood to make from pegging their currency to the US dollar. Pegging their currency to the dollar might have been the ‘rational’ move, but Sioh argues that something other than economic calculation was at work here. By encouraging the perpetuation of racialized hierarchies and issuing warning of the threats that “alien Chinese” posed to Malayan elites, the British managed to position themselves as the continued protector of Malaya during a series of economic and social crises. At the same time, the Britishused capital repatriated from Malaya and from Malaya’s support for the Sterling zone in order to pay off their own debts. For Sioh, what Franz Fanon called “psychological freedom” was achieved later than formal decolonisation, while coloniality continued to operate through financial and monetary arrangements. The extent to which British debts have been paid for by colonial extraction is frequently overlooked in both conservative and ‘progressive’ searches for a largely fictitious past where the “real economy,” undistorted by finance, shares its boundaries with the nation.

This fact is brought horrifically to life in the recent findings of University College of London’s Legacies of British Slave-ownership project. In 1833, following the parliamentary order to abolish slavery in the Empire, £20-million was paid to compensate former slave owners for the loss of their property. Many of the beneficiaries were found to be families and institutions that remain in positions of financial leadership and preeminence to this day, or their derivatives.

Nostalgia: Development and degeneration

Today’s revanchist neonationalisms and imperial nostalgias yearn for a mythical moment of solvency, both in terms of the coherence of national geopolitical and cultural borders and in terms of freedom from debt. Frequently, this mythology is wrapped up in notions of investable private property, which has been a key dimension of financialization and the expansion of financial power over the past four decades. Yet here, too, we find the unquiet ghosts of empire.

A desire for rootedness is often tied to economic nostalgia, and home-ownership plays a vital part in propagating this desire. In settler colonial contexts, the transformation of indigenous land into private property has been instrumental in generating myths about belonging and structures of expropriation. It has also allowed the collateralization and securitization of land – turning property into paper – through which speculative enterprises can be embarked upon. For Hernando de Soto, darling of the World Bank for many years, it is the registration of informally held property (turning land into capital) that allows development, since credit for enterprise can be extended against that capital. De Soto’s most recent initiative marries the speculative imaginaries surrounding blockchain technology with a desire to register property assets worldwide, in the hope that disputes can be ended between local landowners and the state (little is said about how this may take place, when there are overlapping property regimes and large-scale resource or agricultural developers may side with the state), in order to prevent ‘dead capital’ from failing to be profitable in terms of global markets. sitting idly as simple land.

But, as Alexia Yates shows in her contribution to this special issue, the myth that real estate can be ‘stable’ capital (which underpins de Soto’s project) is bewilderingly problematic. Attempts to transform real estate into tradeable capital have had as much to do with speculative bubbles as developmental concerns. Indeed, French colonial North Africa was, in the 19th century, used as a laboratory for the development of property regimes which would provide easy circulation of real estate, removing the barriers that frustrated speculators in France. These ‘gifts’ of legal regimes are of course the same regimes now celebrated by advisors to the private sector wing of the World Bank, and those who argue (in spite of the evidence marshalled by those like Sioh, and Sylla and Guermond) that colonial rule was positive for the colonised, guaranteeing as it did large flows of capital from the metropole to the colonies.

A similar approach has been taken by other authors who note that many of the institutions and technologies that are today pillars of the FIRE (finance, insurance and real estate) sector had their origins in slavery, colonialism and empire, including Anita Rupprecht or Ian Baucom’s investigations of the insurance industry, or Zenia Kisch and Justin Leroy or Peter James Hudson’s genealogies of contemporary financial relationalities.

ReImagining finance for our times

What is at stake in these deliberations?

“Finance” might be understood as a means by which we — as a globally connected species with incredible powers to transform our planet — coordinate our activities, though a means that, obviously, is far from democratic. Speculative capital defines the way goods and services move about the earth, acts as a new disciplinary mechanism for controlling labour power, and is on the mind of every policy-maker. Financial pressures, signals and forces, which are increasingly speculative, automated and concentrated in a few corporate hands, not only shape markets but drastically superintend governments large and small, and also increasingly influence the decisions and imaginations of social actors the world over, from the very rich to the very poor.

Yet nearly all these actors agree that the system is broken, even (increasingly) for the beneficiaries of that system. Change is coming, though it may not be the change for which we might hope.

If we fail to account for the colonial debts, extractive nostalgias and imperial insolvencies that define finance and financialization then that change will no doubt reproduce or renovate the patterns of (neo)colonialism, racism, imperialism and exploitation. Whether the alternatives we pose are inspired by a return to Keynesian regulation of markets, a revivification of Marxist hopes for an emancipated society, or take courage from non-aligned or Third World visions, we believe it is extremely important to attend to these questions as we struggle to theorize, describe, arrest or transform finance’s power.

References:

1. Cain, Peter. 1985. J.A. Hobson, financial capitalism and imperialism in Late Victorian and Edwardian England. The Journal of Commonwealth and Imperial History, 13 (3), 1–27.

2. Haberly, Daniel and Wójcik, Dariusz. 2015. Regional blocks and Imperial legacies: mapping the Global Offshore FDI Network. Economic Geography 91 (3).

3. Ferguson, N. and Schularick, M. 2006. The Empire Effect: the Determinants of Country Risk in the First Age of Globalization, 1880-1913. The Journal of Economic History 66 (2): 283-312.

4. Koelble, T. & LiPuma, E. 2006. The Effects of Circulatory Capitalism on Democratization: some observations from South Africa and Brazil. Democratization, 13(4): 605-631.

5. Sioh, M. 2010. Pricing race, circulating anxieties, and the fate of Malaya’s currency reserves at Independence. Cultural Critique 65: 115-139.

6. Rodriguez-Muniz, M. 2015. Intellectual inheritances: cultural diagnostics and the state of poverty knowledge. American Journal of Cultural Sociology 3(1): 89-122.

7. MacKenzie, D. (2005) ‘Opening the black boxes of global finance’, Review of International Political Economy, 12(4), pp. 555–576.

Clea Bourne is a Senior Lecturer in the Department of Media and Communications at Goldsmiths, University of London. Her research critically examines the role of global financial discourses in privileging and marginalising subjects in mature and emerging markets. Clea is the author of Trust, Power and Public Relations in Financial Markets, published by Routledge in 2017. Paul Gilbert is a Lecturer in International Development at the University of Sussex. He tweets @paulrgilbert. Max Haiven is Canada Research Chair in Culture, Media and Social Justice and an assistant professor at Lakehead University, Ontario, Canada. His books include Cultures of Financialization: Fictitious Capital in Popular Culture and Everyday Life (2014) and Art After Money, Money After Art: Creative Strategies Against Financialization (2018). Johnna Montgomerie a Reader in International Political Economy at King’s College London. Her research interests include finance, debt, macroeconomics and the household sector, money and banking, income distribution, unpaid labour and care. She is currently a Council member of the Progressive Economy Forum and co-Convenor of the International Political Economy Group (IPEG).

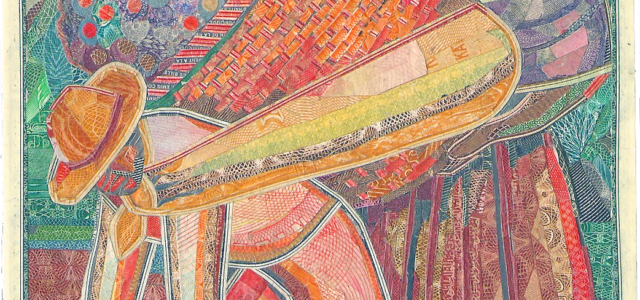

Image Credit: C.K. Wilde, “The Flower Seller’s Wife (After Rivera)” Currency Collage