Nigel Dodd (LSE)

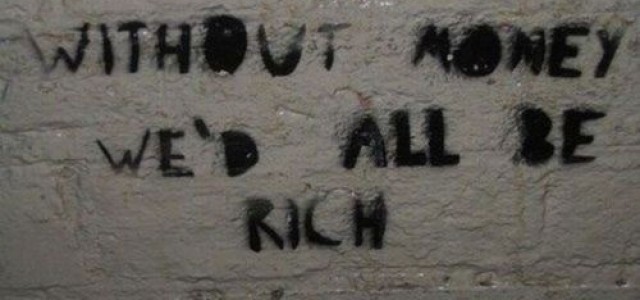

We are used to thinking of the relationship between money and inequality in rather obvious ways. Members of the 1% have a disproportionate amount of money. But money connects to inequality in an equally more important, but less visible fashion. This is especially true for those who need credit most. The connection between money and inequality isn’t just a question of how much money you have, whether earned or inherited. It is also related to the social organization of the monetary and financial system, which is ‘weighted’ in favour of certain groups, in ways that correlate not only to income but to race and gender, too (remember that subprime loans were much more likely to be offered – and aggressively sold – to blacks and Latinos than to whites, even when on similar incomes).

I wrote about some of these issues recently in the Financial Times (‘Cast aside the moral judgment and give debt the credit it deserves’). I pointed out that, universally, debt has been given a negative moral evaluation, and credit a positive one. Linguistic associations between debt and guilt – both are Schuld, in German – reflect this. Perhaps for this reason, we tend to judge debtors, and to regard them as morally inferior to creditors. But debt and credit have no intrinsic morality, and creditors have no inherent moral superiority when compared with debtors. Credit should be available to those who need it, and at reasonable rates, I suggested. I wasn’t particularly surprised to discover that readers of the FT did not agree. ‘You might want to cast aside moral judgement on debt, but I won’t’, one commented. ‘If people want debt, they can have it as long as they repay it’, announced another, before adding revealingly, ‘and as long as they do not complain about the prevailing rates’. Not a single reader referred to payday loans, or to the fact that many subprime borrowers were aggressively targeted by banks who immediately sold them on for high fees. The subprime business destroyed the social connections that reside at the heart of any debt relationship, and all these readers now felt able to do was blame the debtors. Their reaction underlines the hypocritical moral economy that sustains financial injustice.

If you are looking to make a profit by lending money, poorer people will always deliver a higher return. Or to put it another way: money costs more when you’re poor. There is old saying – if you need a bank loan, you have to prove that you don’t need one. If you can’t, you end up paying higher rates of interest to compensate the lender to accepting the ‘risk’ that you represent. No matter that high rates make you even riskier prospect than you were before, this is the logic that gave us subprime mortgages and payday loan companies such as Wonga, offering to lend people money at rates of up to 6000 per cent per annum.

Payday loan rates will be capped from 2015 onwards, at a rate of 0.8 per cent per day, which works out at 292 per cent per annum – still considerably higher than your average credit card, which is typically around 18 per cent per annum. There is a great spoof advert for Wonga. The tagline reads: “if you are stupidly desperate, or just desperately stupid, apply for a wonga.com loan today”. The key word here is desperate, not stupid. People take out loans at such rates because they have no other choice.

Some of the new forms of money and social credit that are emerging now – from local currencies such as the Brixton and Bristol Pound, through peer-to-peer lending schemes, to digital payment systems such as M-Pesa, to Bitcoin – are intended to address social inequalities in the availability of credit. Take peer-to-peer lending schemes such as Zopa, RateSetter and Funding Circle. They lower costs by bypassing banks, and level out the playing field by and making borrowers and lenders more visible and more accountable to each other. Lenders can often see what their funds are needed for, and get a much better sense of what happens to their savings. Using such schemes isn’t necessarily more risky, either, because data is available on borrowers’ reputations, rather like on eBay. Likewise if you are a borrower, you can go to Zopa and may get a better deal than with a bank – certainly better than with Wonga! – or even get a loan when a bank might have said no. These schemes aren’t perfect, of course, but at least they are drawing attention to inequalities that were previously hidden inside the design of money.

Money costs more when you’re poor in terms of payment services, too. Remittances payments – from migrant workers back to their families, for example – take up an increasingly large share of the money flowing into countries such as Armenia, El Salvador and the Philippines, sometimes making up as much as a third of GDP (see data from the World Bank). Yet the cost of making such payments is absurdly high. Remittances transfers through established companies such as Western Union routinely attract fees of 12 per cent on average. Once again, there are some exciting innovations that are addressing these inequalities. M-Pesa, launched by Vodafone in 2007, is a system that uses mobile telephones to transfer money. The scheme, which is especially popular in Kenya, Tanzania, South Africa, India and some parts of Eastern Europe, has reduced fees to an average of closer to 7 per cent. Payments through M-Pesa are tiny. In Kenya, for example, where there are 8.6 million registered users (out of a population of just over 44 million), around half of all transactions are less than US$10, and the average is US$33. And the cost-cutting innovations continue. In June this year, a Bitcoin-denominated variant of M-Pesa was launched, as BitPesa. Although it is early days, this service has cut the costs associated with remittance payments by roughly half, from 7 per cent down to around 3 or 4 per cent.

One of the most interesting debates taking place today is about the future of payment services, as providers such as Visa and Mastercard, Paypal and so on compete to provide the ‘rails’ on which our money travels – each standing to make just a few percent on our regular transactions, which is actually very lucrative. Here too, connections between money and inequality operate in ways that are not always obvious, and with implications we need to think through carefully. In the UK, cash now makes up less than 3 per cent of all transactions. Increasingly, we are using plastic cards of one kind or another, or other kinds of money transfer involving ‘wave and pay’ with our phones or, in the case of the Brixton and Bristol Pound, payment via SMS. What this means is that our use of money will be increasingly bound up with the ways in which our identity as citizens is recorded and verified, and our movements tracked. There are issues relating to inequality that arise here, too. While not everyone wants a credit card or a bank account, not everyone is allowed to have one, and yet it is increasingly difficult to survive in the mainstream economy without plastic money of one kind or another. Cash is no longer allowed on London buses, for example, while anyone who tries to buy something big with cash is likely to be treated with suspicion. While being able to wave and pay as we board the bus or tube seems hugely convenient for many of us, it is a very public manifestation of financial exclusion for others.

As more and more electronic payment services are taken over by private corporations, old-fashioned cash is becoming more difficult – not just more costly – to use. Owning credit cards gives us access not only to financial services – you are unlikely to be offered a mortgage without having a credit card in the UK, for example – but is an important marker of a legitimate identity. If you don’t have a credit card or a bank account, you have an ‘incomplete’ identity and you will not have access to important goods and services – even your rights will be compromised. So not just loans but the very mechanics of payment itself are implicated in the reproduction of inequality and social power. In this sense, as I suggest in The Social Life of Money, it is important that we think of payments services as a public service that needs to be protected. The state still has a significant role to play here, because there isn’t any other institution that is charged with (or capable of fulfilling) the job of protecting our public goods. Finally, it would be quite wrong to think of initiatives such as Bitcoin as providing a solution to the issues I’ve raised here. While Bitcoin may well prove significant in lessening the costs of remittances – BitPesa really is an exciting development, although it’s too early to say how successful it will be – the Bitcoin system has a social structure of its own which does not just mirror the kinds of disparities we already see in the mainstream financial system, but extends them. Bitcoin does not have a 1 percent, but rather a 0.1 percent: ‘We are the 99.9 per cent’!

Nigel Dodd is Professor in the Department of Sociology at the LSE. He is the author of The Social Life of Money, published by Princeton University Press.